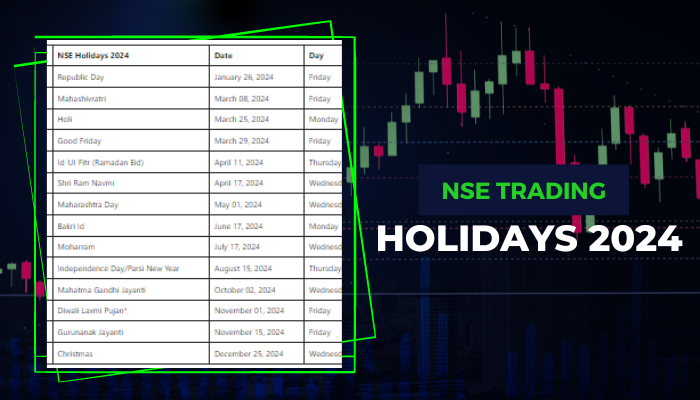

NSE Holidays List 2024

Often people are unable to make profits because they fail to select appropriate stocks to trade. Flag as inappropriate. Also in the comments above you pointed out platforms that have the tell tail signs of a scam, what are those signs. Any loss is offset by the premium received. Webull offers attractive, easy to use downloadable platforms with a short learning curve that will have beginners quickly up and running. If your broker prefers such methods, it’s a red flag. Here’s an example of a chart showing a trend reversal after a Gravestone Doji candlestick pattern appeared. Use limited data to select content. Only Interactive Brokers currently offer access to U. Traders today have access to a wide range of educational materials, online communities, and tools — often for free. Largest market in terms of daily trading volume in the world. Details of Compliance Officer: Mr. The price of a contract with high gamma, a reading near 1, will be very responsive to changes in the price of the underlying security. That could happen for different reasons, including an earnings report, investor sentiment, or even general economic or company news. But most investors will still like to see some detail to the graphs they can access in app. Double top and bottom analysis is used in technical analysis to explain movements in a security or other investment, and can be used as part of a trading strategy to exploit recurring patterns. Only money that you receive, such as dividends, will be taxable. The most common way for retail traders to participate in the forex market is through trading pairs, such as EUR/USD Euro/US Dollar or GBP/JPY British Pound/Japanese Yen. However, your maximum risk is potentially unlimited if the market moves in favour of the option holder. In day trading, it is important to manage risk effectively. It’s also important for traders to understand the risks and limitations of AI trading and to use these tools responsibly. Of course, there are going to be different levels of what’s offered through these different apps.

![]()

Stock Trading

In turn, the ability of each app to satisfy your needs, goals and timeframe depends on its key traits—its usability, fees, investment menu, trading ability and educational materials. Furthermore, they must make sure to put in a stop loss for all orders. Momentum traders focus on stocks moving significantly in one direction on high volume. A limit order guarantees the price but not the execution. For example, platforms like MetaTrader provide advanced charting tools and technical indicators for in depth market analysis. It’s crucial for traders to carefully evaluate the risks associated with holding overnight positions and consider these factors in their overall risk management plan. The best stock trading apps offer flexible trading options, customized portfolios, market research, low fees, and access to beginner friendly and advanced trading strategies. So, this is my first time browsing your site and I can see you have some useful info on the site; however, what I noticed is that almost all of your teachings are based off of a ‘daily’ chart. Instruments like RSI, Bollinger Bands, and others have become cornerstones in traders’ arsenals, celebrated as top indicators for option trading due to their reliable and actionable data. Investment Biker: Around the World with Jim Rogers’ explores the world of finance in a completely unique way. The cup and handle is a well known continuation stock chart pattern that signals a bullish market trend. Hedging FX risks is an essential part of international business today. Unfortunately, Exness Insights is not available in your location. Under the product selection process, we undergo extensive market research, finding different products and services in a particular category. Buying stocks online involves opening an account with a brokerage firm, funding the account, researching and selecting stocks to purchase, and placing an order through the broker’s trading app or platform. Overall, crypto apps come in many different types and serve various purposes, catering to the needs of different types of cryptocurrency investors. Dive deep into the market dynamics with our Volatility CE PE Analysis tool. So the way conversations get created in a digital society will be used to convert news into trades, as well, Passarella said. The upper portion of a candle is used for the opening price and highest price point of a currency, while the lower portion indicates the closing price and lowest price point. Vattenfall AB is 100% owned by the Swedish state. However, the majority of forex trading volume is found on a handful of forex pairs, including EUR/USD, USD/JPY, GBP/USD, AUD/USD and USD/CHF. As mentioned, trends don’t continue indefinitely, so there will be losing trades. Trade CFDs on a wide range of popular and niche metals, energies and softs. The 50 day simple moving average indicator is an important technical indicator in position trading.

What is the best trading strategy?

App Store is a service mark of Apple Inc. It provides online trading and investment services to more than 50 lakh customers. Swing trading is akin to a versatile actor capable of assuming various roles. The nickname for traders that employ the scalping strategy is “scalpers. The reports will be based on insights into real time expense tracking and the data collected so far. If you are confused about using it, here are key points that reflect its importance in a business. Purchasing a protective put gives you the right to sell stock you already own at strike price A. 50 per https://option-pocket.top/ru/app/ share for a $181. Whether you’re building your first stock set up or updating an existing stock market computer setup, I’ll show you what pro traders use to help them stay at the top of their game. A CFD contract is legally binding. Share Market Timings in India. Stocks and ETFs are generally the most common investment option for free trading. After all, who doesn’t know what a “W” looks like. Navigating the complexities of trading becomes more manageable with guidance from a mentor. No other fintech apps are more loved. Note that when buying call options as CFDs with us, your risk is always limited to the margin you paid to open the position. Sam Levine, CFA, CMT, formerly a lead writer for StockBrokers. However, that’s exactly what successful traders do. The platform is packed to the brim with scores of features, like its unique Gemini Earn program for earning interest on crypto holdings and the Gemini Credit Card. On eToro, you can trade and invest in the world’s most popular markets, and the most desirable assets. Lot Size: Lot size refers to a fixed number of units of the underlying asset that form part of a single FandO contract. What is Futures Trading.

Risks in dabba trading

You can also learn more about MetaTrader 5 and find a great forex broker that offers MT5 by checking out my full MetaTrader 5 guide. Pit Bull: Lessons from Wall Street’s Champion Day Trader’ is a walk through of the career of Martin ‘Buzzy’ Schwartz, who earned the nickname ‘Pit Bull’ after years of successfully trading on Wall Street. They cannot be disabled. Getting a handle on emotional trading requires emotional intelligence to maintain discipline and manage psychological stressors. Read More Personality Test For Successful Traders: Can You Become A Trader Or A Quant. Contrarian trading, or going against the herd, scalping, and trading the news are also common strategies. Historical volatility represents the past and how much the stock price fluctuated daily over one year. Swing trading may be done successfully with almost every time frame, but there is a certain approach that should be used with each one. City Index mobile, MetaTrader mobile. With M1, You can decide to base your investing strategy around individual stocks, low risk ETFs, or create a hybrid of both. By the day’s end, they compare the profit making trades with loss making ones to analyse their loss or profit. Once you’ve put in the relevant price data, you’ll be given a percentage score from which you can assess whether the market is being overbought or oversold. 129, it has moved a single pip. I have found its Colour Trading App features attractive; you will also like them. The ask prices are immediate execution market prices for quick buyers ask takers while bid prices are for quick sellers bid takers. Asking yourself why you’re investing can help determine if investing in stocks is for you. Coming back to my bot development, interestingly, the losses I experienced over the years had a surprising benefit. For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the broker’s data to ensure accuracy. Swing Trading vs Day Trading. Similarly, if the stock moves from $15 and drops to $12, you can assume that it will bounce back. TraderSync’s website uses cookies and third party tracking to improve your experience on the website, collect analytics about the usage of this website and which pages you browse to, and to inform our marketing partners so that they may deliver advertising more effectively. Technical indicators are maths computations plotted on price charts as lines.

What successful traders say about cryptohopper

The top swing trading strategies are Fibonacci Retracement, Trend Trading, Reversal Trading, Breakout Strategy and Simple Moving Averages. Harinatha Reddy Muthumula, TEL: 1800 833 8888; Email: for DP related to , for any investor grievances write to. Check out Fidelity especially if you’re a beginning investor and need to learn and grow in experience on one platform. Strike offers free trial along with subscription to help traders, inverstors make better decisions in the stock market. In fact, retail trading a. Use limited data to select advertising. Here are some key points to keep in mind when day trading. It offers an enhanced stock screener to help filter stocks based on criteria like sector and market cap and users can buy fractional shares for as little as $5. These are wise words to live by if you’re new to the stock market and wondering if trading is right for you. The IG Trading app is an excellent choice for beginners, due to its range of tools, integrated content, and the ability to access educational material from IG Academy and DailyFx it even has a standalone mobile app for education. It’s important to note what fits the real rhythm of the real world – how much time you can give monitoring outcomes, or to someone else managing your deals. If a stock has very little price movement, there is less profit potential since there is likely to be only a small difference between the entry and exit prices. Simply put, if you want to compare your financial performance over time, the trading account format is what you need. Encouraging US residents to trade commodity options, including ‘prediction’ contracts, is against the law unless conducted on a CFTC registered exchange or legally exempted. Because lifestyle matters. What are Penny Stocks.

Investing Quiz –August 2024

Allow you to log in just with your fingerprint. Here are additional advantages. However, in general, you will have to submit the following documentation. Brokers offer online trading platforms to traders for buying and selling stocks, and traders can place different types of orders to trade stocks on their platforms. The cost of goods sold is calculated through opening stocks, direct expenses and purchases. Ignoring any brokerage commission or transaction fees, the trader’s portfolio will rise to $5,445, leaving the trader with a net return of $495, or 10% on the capital invested. If you are having an issue with an opened ticket with our Customer Service feel free to contact us via Facebook or Twitter via DM so we can escalate your case to the relevant team. 20200831 45 dated August 31, 2020 and other guidelines issued from time to time in this regard. For example, many bonds are convertible into common stock at the buyer’s option, or may be called bought back at specified prices at the issuer’s option. AI driven algorithmic trading strategies are also expected to become more prevalent. 56560 NCDEX Membership No. Types of indices you can trade include. Ritika is a Financial Markets Journalist with over 10yrs experience in observing and reporting on events impacting the markets. By clicking Continue to join or sign in, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. Real time market data. This advertisement has not been reviewed by the Monetary Authority of Singapore. This means that for every one point move in NIFTY BANK price, the delta of the option will change by 0. So, here is a quick preparatory guide for futures and options trading for beginners. So, we’ve created a table below with five key trading terms every beginner should know. Before you can trade options, your brokerage firm must approve your account for a specific level of options trading since some strategies involve substantial risk. Technical analysis involves studying charts, patterns, and historical price data to predict future price movements. Don’t miss the next big move. Implementing a trading strategy involves putting your plan into action to take advantage of potential opportunities in the financial markets.

Assists In Analysing The Cost of Goods Sold

I agree to terms and conditions. Short selling is especially risky, as market prices can keep rising, theoretically speaking. The market has not been waiting patiently for you to click buy or sell before going on its merry way. Such indicators include volume, simple average, moving average, MACD, RSI, etc. A wedge chart pattern is a technical analysis pattern that is either bullish or bearish depending on its orientation. Multi broker Connectivity. For example, say a day trader has completed a technical analysis of a company called Intuitive Sciences Inc. As the structure of the derivatives offered by Binance falls outside of traditional trading regulations, it is able to offer leverage of up to 1:125. Finally, don’t assume that an exchange is available in your country, or even state, just because you can access its website. The purchaser will only realize their gains if they sell their option position or the position resulting from the exercise of their rights under the contract. Mercedes Barba is a seasoned editorial leader and video producer, with an Emmy nomination to her credit. Financial markets typically have three prevailing long term trends: the bear market, the bull market, or somewhere in between. But maybe you also have a chance of losing it is less. $0 commission for online U. From the following ledger balances extracted from the books of Mr. However, blocking some types of cookies may impact your experience on our website and limit the services we can offer. Price rejection is when the price tries to move through an important level, but then reverses direction because there is not enough force to maintain the trading momentum. 8% retracement level acting as a resistance level, with the aim to exit the sell position for a profit when price drops down to and bounces off the 23. A stop loss ensures that the losses are kept at a minimum while you strive to generate disproportionate profits. Crabel has had some influence on technical analysis, and he often suggested that day traders are social psychologists with a computer program. Offer not combinable with other offers. If you know your way around Java, Swift, or Kotlin, you’ll be in high demand for mobile app development. The Investopedia 100 spotlights the country’s most engaged, influential and educational advisors. Best research experience. One Up On Wall Street’ was written by Peter Lynch, one of America’s most famous fund managers and investors. Trend following, or momentum trading, is a strategy used in all trading time frames, assumes that financial instruments which have been rising steadily will continue to rise, and vice versa with falling. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A stop loss level can be calculated with a risk/reward ratio. They were initially used in Japan by rice traders in the 1600s. OnETRADE’sSecure Website.

Final Thoughts:

If an investor has a debit balance in a margin account, they will owe money to the broker. When it comes to investing, selecting the best online brokers is a crucial decision. Explore what’s needed in your community then develop and market your skills to meet that need. We do not provide real time data. What a bunch of slackers. Below we’re walking through a hypothetical call option and put option purchase. When the Asian session ends, the European one begins; when the European one ends, trading starts up in North America. Everything else is irrelevant. You can download it for free. As you are aware, under the rapidly evolving dynamics of financial markets, it is crucial for investors to remain updated and well informed about various aspects of investing in securities market. American style contract. CFD traders will also have to pay a commission charge in addition to the spread when trading shares. That means a portfolio of five concentrated swing trades would represent 10% 25% of total trading account capital on average. Everyone knows this is a safe Android Colour Trading App that everyone wants to download. These strategies include the following. NMLS Consumer Access Licenses and Disclosures. This is why many recommend high liquid stocks like large cap stocks. Com has some data verified by industry participants, it can vary from time to time. This phase involves not only understanding theoretical concepts but also applying them through simulated trading platforms or small scale real investments, which is crucial for gaining practical experience. Easy Option Strategies, Pay off charts, Strategy Builder and More with sensibull. Remember, with us you can only trade derivatives via CFDs. One of the most popular combinations is a straddle. Mercedes Barba is a seasoned editorial leader and video producer, with an Emmy nomination to her credit. The app is designed to notify users of any changes in the market, including price fluctuations and trading volume. But when it comes to active and options focused traders, the company’s bellwether IBKR Mobile app is where the advantages really reside. Breakout trading strategy identifies key levels of support or resistance and entering trades when the price breaks out of these levels. It is one of the few exchanges designated for trading currency options in the U. Measure content performance. You then build a statistical model based on this information.

Track Market Movers Instantly

You can lose your money rapidly due to leverage. 44894, trading as Capital International SA, is licensed by the Financial Sector Conduct Authority in South Africa. For day traders, trend following requires rapid execution and diligent risk management, given the shorter time frame and higher transaction costs. Lees ons privacybeleid en cookiebeleid voor meer informatie over hoe we je persoonlijke gegevens gebruiken. For call options, that means the cost associated with doing so in other words, the money to buy 100 shares of the underlying stock will be due at that time. Excessive emotional trading is one of the most common ways investors damage their returns. Sumit pratap Singh 24 Jan 2023. Whether you’re experienced in active trading, just starting, or want to set and forget experience, the Schwab mobile app can be customized to meet your unique needs and preferences. This chart shows both a regular inside bar signal as well as an inside pin bar combo setup. Hone your skills by applying strategies in live markets. As a Strategy for Day Trading, a robust trading strategy traditionally used for long term investments in various asset classes, can also be adapted for day trading. Take 2 mins to learn more. 8% on a stock chart can reveal potential https://option-pocket.top/ reversal levels. Instead of starting with a rival platform that seems easier or cheaper, you’d probably be better off starting with Betterment’s app to take advantage of its leading platform and low fee access to all investment account and goal types. Use the broker comparison tool to compare over 150 different account features and fees. Check out the best stock trading apps with low fees, as picked by Business Insider’s editors in 2024. That can make it harder for investors with less cash to buy the security they want. This can be a good sign as it suggests that there is a lot of interest in the option, which could lead to increased liquidity and tighter bid ask spreads. Good to know: Research and data is lacking here, and advanced traders may find Public’s tools too entry level for their needs.

Earn Huge Exclusive Binance Learners Rewards

Position traders tend to use both fundamental and technical analysis to evaluate potential trends. Plus500 is recognized for its simplicity and user friendly interface, making it an excellent choice for beginners. Options traders, meanwhile, can achieve leverage through the nature of options contracts themselves. Then, click the Options button from the left navigation menu, and enter the ticker symbol of the underlying asset. Free stocks and ETFs: European clients can trade real stocks and ETFs commission free up to €100,000 in monthly volume. It’s one of the few brokers in the industry that offers unlimited, complimentary access to financial planners, a no advisory fee robo advisor for automated investing and matching IRA contributions. Many professional money managers and financial advisors shy away from day trading. Before investing, you should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Other

Manage your portfolio with ease on iOS, Android, or your web browser. The head and shoulders chart pattern is a bearish reversal pattern that occurs after an uptrend in the market. This usually involves holding securities from a few days to a few months. “Option Trading in Your Spare Time: A Guide to Financial Independence for Women” by Wendy Kirkland and Virginia McCullough. Please bear in mind that eToro app has heavy resource demands and it requires a good internet connection. As always, it is best to practice a strategy before putting money to work in the market. Since Algorithmic trading relieves you from the burden of placing the orders manually, many people believe that algorithmic trading is easier than manual trading. 743 independent reviews. Who are they best for. Written by Sam Levine, CFA, CMTEdited by Carolyn KimballFact checked by Steven HatzakisReviewed by Blain Reinkensmeyer. It has been observed that certain fraudsters have been collecting data from various sources of investors who are trading in Exchanges and sending them bulk messages on the pretext of providing investment tips and luring the investors to invest in bogus entities by promising huge profits. Having plans for every likely scenario increases your chances of closing your trades without losses. Thinkorswim mobile requires a wireless signal or mobile connection. Typically, you need to provide 20% of Rs 500 as your initial investment, which amounts to Rs 100. However, day trading also involves high risk and potential for significant losses. With respect to margin based foreign exchange trading, off exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument.

TraderSync is a comprehensive suite of research, analysis, and trading tools designed to assist traders and investors in making their own decisions We do not provide recommendations regarding specific securities to buy or sell, and we do not offer trading or investing advice Trading carries significant risk and may not be suitable for every investor There is a possibility of losing all or more than the initial investment

This strategy has not been trading long enough to reliably calculateCompounding Annual Growth Rate CAGRbased on the live trading data. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. With the paperMoney tool, a trading simulator that mirrors the thinkorswim trading platform, you can try new trading strategies and understand the application before risking real money. It should always be used in conjunction with other technical analysis tools and indicators to confirm your trading decisions. By analysing the habits of successful fund managers, the book supplies valuable insights into turning trading ideas into profitable actions. Banks with reserve imbalances may prefer to borrow from banks with established relationships and can sometimes secure loans at more favorable interest rates compared to other sources. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Derivatives Resources. $0 for online stock and ETF trades. Traders can virtually eliminate any risk associated with trade by combining options. Stock options are listed on exchanges like the New York Stock Exchange in the form of a quote. Plus500 also employs advanced security technologies, including SSL encryption and two factor authentication, to ensure the safety of users’ data and funds. Research: Thorough research and analysis of the present market scenario, company fundamentals, and knowledge of macroeconomic factors, such as the country’s debt status or currency movements. This is one of the most important aspects of interpreting candles. Tracking sales helps assess your company’s revenue generating capabilities.

Benefits

You want to pick one that can bring you as close to the real world experience as possible. Com has all data verified by industry participants, it can vary from time to time. Armed with a solid grasp on swing trading fundamentals, an explicit plan in place and a rigorous adherence to risk management principles, you can steer through the markets’ undulations toward potentially substantial gains. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. All of it still holds up after years of trading, I only have hard time catching up to all the new updates and improvements, so reading acticles like this binance review makes the process easier. The Pattern will find a new support level and offer a trader another chance to start a long position or go short when the price of the Stock breaks the neckline or resistance. The foreign exchange forex market uses a four decimal quoting convention with pips for the tick size. You may have to pay third party fees, however, like mutual fund transaction fees and fees for options contracts. Depending on your goals and the risks you may be exposed to, you can choose between a set of risk management tools. As a multi asset platform, eToro enables European investors to build diversified portfolios from a single account.

NSE GO BID

Plotted between zero and 100, the idea is that the price should make new highs when the trend is up. Make the most out of every trade. Please do not share your personal or financial information with any person without proper verification. Under this, traders will receive a separate bank savings account to store their gains and pay for securities they purchase. In addition, we’ll look at the variety of technical indicators swing traders master to make judgement calls on whether it’s worth going long or short on an asset. Securities and Exchange Commission. Various financial trading operators offer copy trading capabilities as part of a larger social trading platform. Where certain metrics fall below a certain value, BAD THINGS will happen. VT Markets Limited is an investment dealer authorised and regulated by the Mauritius Financial Services Commission FSC under license number GB23202269. It’s a new service, I prefer to stick with more established ones. Paid non client of Betterment.